iowa homestead tax credit calculator

The property owner must be a resident of Iowa pay Iowa income tax and occupy the property on July 1 and for at least six months of every year. Any owner of property in the state of Iowa who resides in that property can take advantage of the homestead credit.

Auto Loan Calculator With Tax Tag Fees By State

The homestead credit is calculated by dividing the homestead credit value by.

. New applications must be made with the Assessor on or before July 1 of the year the exemption is first claimed. 100 Actual Value x Rollback Rate by Property Class Gross Taxable Value less Military Exemption Net Taxable Value x Consolidated Tax Levy Rate Gross. For most taxpayers the Homestead Credit equals 4850 divided by 1000 multiplied by the Tax Levy Rate multiplied by 77.

Change or Cancel a Permit. In 2021 the Iowa legislature passed SF 619. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value.

New applications for homestead tax credit are to be filed with the Assessor on or before July 1 of the year the credit is first claimed. What is the Credit. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value.

The Military Tax Credit is an exemption intended to. Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on. Register for a Permit.

This is an exemption that reduces the property owners taxable value. 52240 The Homestead Credit is available to all homeowners who own and occupy the. Parcels with an Agricultural Class of at least 10.

Roll back percentage 2015 last year roll back 0557335. To be eligible a homeowner must occupy the. If the homestead tax credit computed under this section is less than sixty-two dollars and fifty cents the amount of homestead tax credit on that eligible.

Equals the net taxable value divided by 1000 multiplied by the tax levy rate and rounded to the nearest cent. Iowa City Assessor. 913 S Dubuque St.

As with the Homestead Tax Credit the exemption remains in effect until the. Track or File Rent Reimbursement. How do I estimate the net tax for a residential property with Homestead and Military Tax Credit.

Calculation is as follows. In the case of a Disabled. What is a Homestead Tax Credit.

As with the Homestead Tax Credit the exemption remains in effect until the. New applications must be made with the Assessor on or before July 1 of the year the exemption is first claimed. Once a person qualifies the credit continues until the.

2 enter the rollback x0548525. Iowa Homestead Tax Credit Calculator. The property owner must.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Application for Homestead Tax. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the.

Can A Homestead Exemption Lower Your Mortgage House Of Debt

Tangible Personal Property State Tangible Personal Property Taxes

Should You Move To A State With No Income Tax Forbes Advisor

Calculating Property Taxes Iowa Tax And Tags

Choose The Best Texas Property Tax Loan Provider Federal Lawyer

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Disabled Veteran Property Tax Exemptions By State And Disability Rating

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

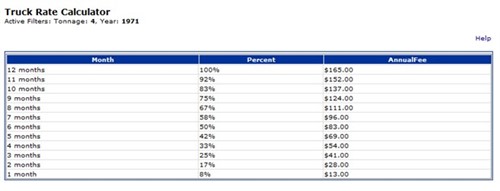

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Eligibility Expanded For Elderly Property Tax Credit For Those Aged 70 Polk County Iowa

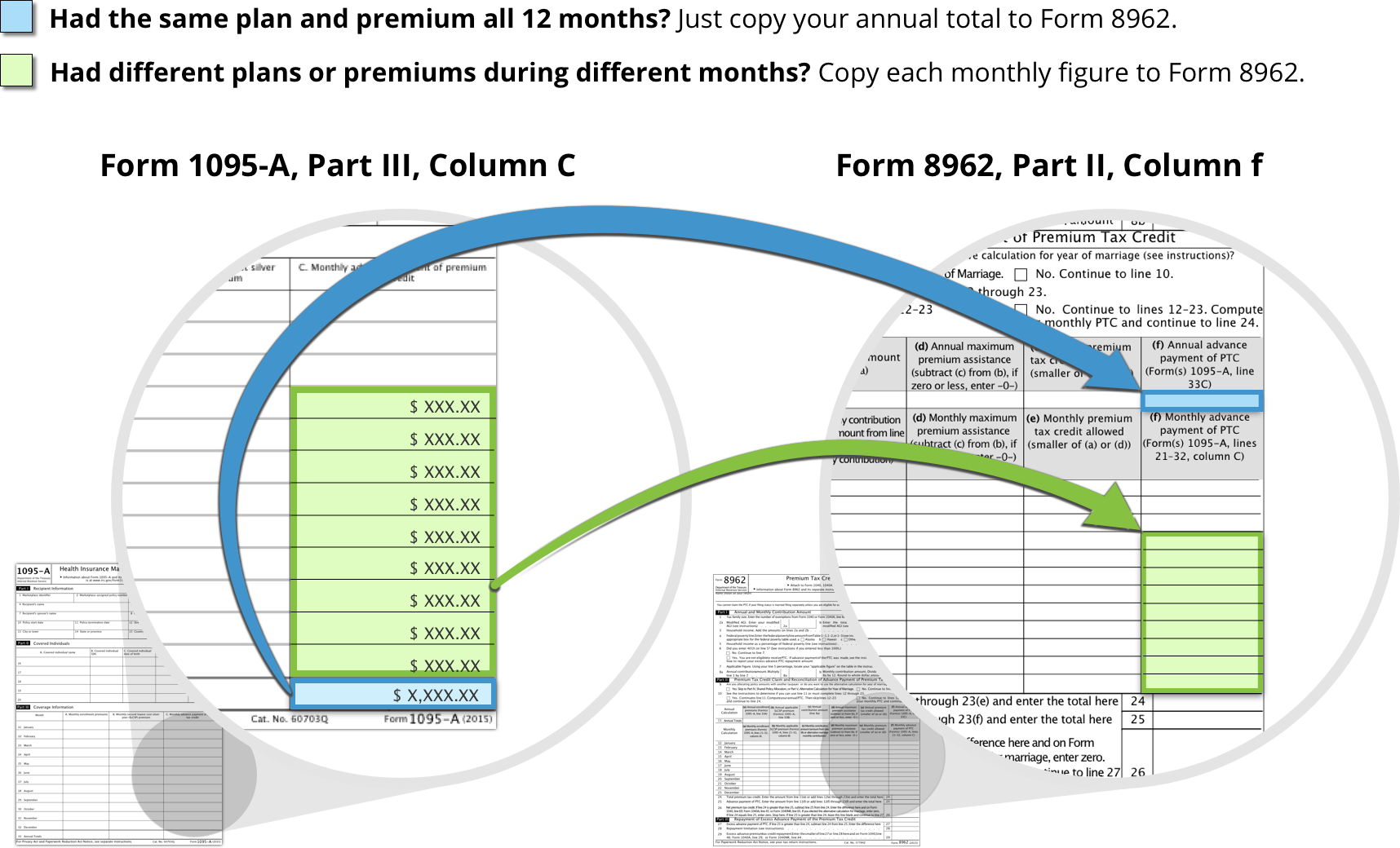

How To Reconcile Your Premium Tax Credit Healthcare Gov

What Goes Into Calculating Your Property Tax Bill

Those Crazy Iowa Property Taxes Home Sweet Des Moines

State Tax Incentives For Small Farms Wolters Kluwer

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool